Stochastic Private Capital Fund Dynamics – On Asset Level

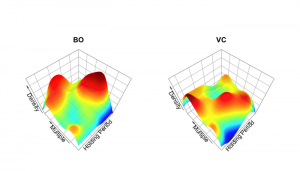

These continuous time stochastic models describe the cash flow dynamics of private capital funds on asset level. Analogous to credit risk modeling, it is reasonable to differentiate between structural and reduced form approaches in the private equity fund context. Structural models commonly choose asset value processes of Gaussian-type, e.g. multivariate geometric Brownian motions. The reduced form approach is naturally based on a multivariate marked point process.

My PhD project aims to enhance the risk perception in private equity.

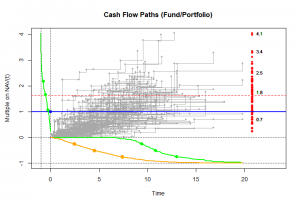

Ultimately, specified models can be applied for detailed Monte Carlo simulations.