How I Taught my AI Assistant to Beat the Market

Happy 1st Birthday, Marylin. 🎂

Exactly one year ago today, on December 26, 2024, I didn’t unwrap a present; I launched a Wikifolio strategy named Marylin. She wasn’t a fully autonomous robot, and she certainly wasn’t a gut feeling. She was—and is—the almost ultimate investment assistant. A 100% LLM-driven Python project designed to process more information than any human could, helping me execute a strategy with one clear goal: outperform.

As I look at the charts today, with Marylin significantly beating not just the broad market, but my specific, high-bar benchmark, the MSCI Next Generation Internet Innovation Index (Xtrackers ETF in EUR), it looks like a victory lap.

But the journey to get here was anything but a straight line. It involved late-night API experiments, a sweaty-palmed first half of 2025, and a mid-year realization that changed everything.

Sounds cool, but why? 🤷♂️

| Annual Growth Rate | Return Multiple after 10 Years | Return Multiple after 20 Years | Return Multiple after 30 Years |

|---|---|---|---|

| 8% | 2.16x | 4.66x | 10.06x |

| 10% | 2.59x | 6.73x | 17.45x |

| 12% | 3.11x | 9.65x | 29.96x |

| 15% | 4.05x | 16.37x | 66.21x |

| 20% | 6.19x | 38.34x | 237.38x |

This table explains why we do this. If we can achieve an annualized return of 15% per year, we can turn an investment of 10,000€ into 662,100€ after 30 years. A diversified world index with 8% annually would “only” turn 10,000€ into 100,600€ in the same period. Each percentage extra return counts!

The “Garage Phase”: Autumn 2024 🚀

The seed for using AI for investing was planted last autumn—encouraged by the release of OpenAI’s seminal o1 thinking model. While the world was debating if LLMs were safe, cheap or smart enough (agents were not yet the hot topic), I was interested in something more practical: Can they be the perfect analyst?

I realized early on that LLMs aren’t magic boxes. They have limits—often metaphorically described as “context windows”—and they can hallucinate or go crazy. But if you treat them as tireless interns who can scour the entire internet for financial data, they become powerful.

I built Marylin to aggregate vast amounts of online financial information—annual reports, earnings calls, news, market chatter—and transform that chaos into high-signal indicators of outperformance.

Initial commit to the GitHub repository was on Nov 29, 2024.The Ghost of Charlie Munger 🤖

“Take a simple idea very seriously.”

Charlie Munger

Most people fail with AI investing because they use it for “data mining” or relying on “backtests”. They look for patterns in the noise. I wanted Marylin to look for value.

I built Marylin’s architecture on Mungerian principles, but translating philosophy into code is a never-ending challenge.

The exact prompting architecture is, of course, a big business secret, but the core concept is control. You have to explicitly tell the prompt your preferred business philosophy to stop it from hallucinating or following the herd. I am still refining this structure continuously—in fact, I committed the latest change to the prompt structure literally today.

It is an iterative process of adding content and constraints until the AI thinks like a value investor, not a hype machine. I started like this:

- Make a plan: Identify great, undervalued growth companies.

- Implement it algorithmically: Use code to remove emotional bias from the analysis.

- Do what works: Focus on economic principles and conviction rather than luck or short-term trends.

The First Half of 2025: The Valley of Doubt 🥺

I launched on Dec 26, 2024, ready for glory, caviar and champagne. Instead, I got humbled.

For the first five months of 2025, Marylin didn’t just underperform; she was confusing. My initial system was too simple. The portfolio was a mess of over 20 positions, all roughly equal-weighted because the algorithm lacked real conviction. Worse, these positions changed too starkly with every monthly update, churning the portfolio without direction.

I also discovered a “parroting” problem. In the beginning, Marylin was obsessed with NVIDIA, consistently ranking it at the top of her buy list. She was biased by the massive amount of training data praising the stock, ignoring its high valuation at the time. She was extrapolating the past rather than analyzing the future—a classic rookie mistake. It was clear I needed a method that was more concentrated and stable.

Alternatively, I could simply believe the conventional Efficient Market wisdom, taught in every Finance 101 classroom: You cannot beat the market. Don’t even try…

In short, the strategy demanded discipline: Be consistent. Be empirical.

The Mid-Year Fix: Multidimensional Scoring 👨🔬

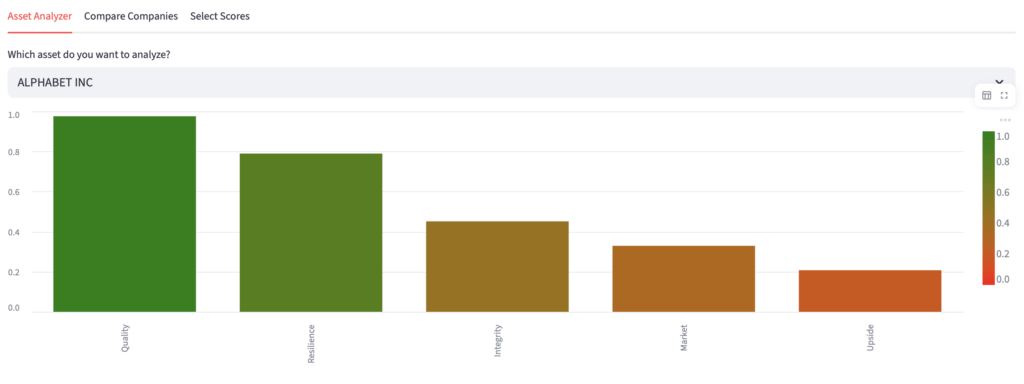

I went back to the Python backend and overhauled the scoring logic. I realized that, to generate a strong signal, I needed to combine several specific scores into a holistic view of a company. To achieve this, your favorite 2025 AI benefits from clear guidance in the form of explicit prompts, scaffolding, and a well-defined philosophy.

For repetitive tasks, we generally do not want the AI to reinvent the wheel on every API call by invoking an ultra-heavy reasoning mode. Instead, we should prompt it precisely with what we want.

I stopped asking the AI for simple buy/sell/alpha signals and started demanding deep-dive scores on:

- Valuation: Is the price justified by the cash flows?

- Moat: Is the competitive advantage durable?

- Bright Future: Is there a verifiable macro tailwind?

- Business Model: Is it scalable and robust?

- Short-term Upside: Is there momentum?

- And many more…

I spent weeks fine-tuning the parameters, teaching Marylin to ignore the hype and focus on the business.

The proof that this worked wasn’t in a backtest, but in a live trade: Alphabet.

While Marylin didn’t “discover” this large-cap giant, she consistently highlighted a discrepancy between its price and its multidimensional score—one that some overly pessimistic humans might have dismissed six months ago. As the stock rose, traditional finance wisdom (and my own fear) would have screamed to sell and diversify. Marylin did the opposite. She encouraged me to build a position larger than 20% of the total portfolio.

The trade timeline reveals the strategy in action: I initiated Alphabet at 6.9% on May 5th, increased to 11.3% on June 2nd, then came the decisive moment—on July 1st, Marylin’s scoring system signaled to double down to 23.4%. While conventional wisdom would suggest taking profits, the data said otherwise.

From there, I simply held. As Alphabet soared through the second half of 2025, the position grew to 33% through price appreciation alone. Without Marylin’s analytical conviction, I likely would have trimmed this winner far too early. Instead, she kept me in the trade, and Alphabet became the anchor of our outperformance.

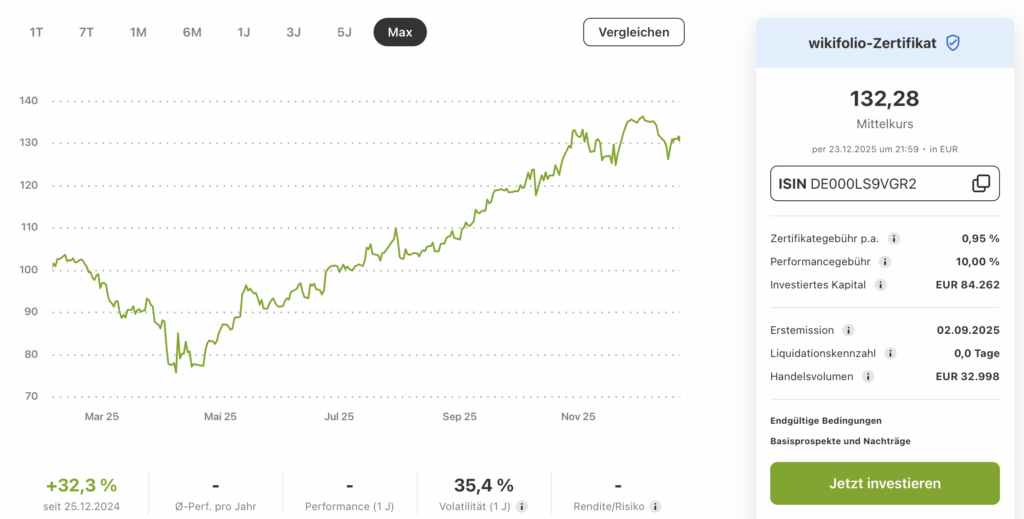

The Turnaround: Crushing the MSCI Next Gen 💸

The result in the second half of 2025 was aaahhh… amazing.

The algorithm began to better separate the signal from the noise (supposedly 😉). It filtered a global universe of ~300 stocks and ETFs down to a more concentrated, high-conviction list of 5 to 15 positions. And its assessments made much more sense to me now.

The performance gap widened. Marylin began to consistently outperform the MSCI Next Generation Internet Innovation Index—a benchmark that historically beats the Nasdaq 100 and is notoriously hard to beat.

Performance Snapshot (from Dec 26, 2024 to Dec 26, 2025):

- Total performance (after fees): 32.28%

- Alpha vs Benchmark: +26.03%

- Sharpe Ratio: 1.3

- Sortino Ratio: 1.8

- API Cost: ~1500€

The Perfect Assistant (Not God-like Master) 👩💻

It is important to clarify: Marylin is an AI-Assisted Asset Management System, not a black box. Not a fully autonomous trading agent (yet).

The AI does the heavy lifting—the analysis, the scoring, the screening. It provides the data-driven foundation. But the final execution, the “sanity check” on portfolio weights, and the actual trading are done by me.

This partnership is the secret sauce. Marylin removes the cognitive load and the emotional bias, allowing me to make decisions faster and with higher conviction. And…

HIGH CONVICTION IS KEY TO UNLOCK ALPHA.

Thus, distinguishing high-conviction from over-confidence is a vital part of Marylin’s job description.

What’s Next? 🦾

Marylin is just one year old. She has no ego, never gets tired, and helps me identify and seize opportunities I might have missed on my own.

We are entering the era of superhuman investment assistants. The goal is not to replace the human—at least not yet—but to empower the human with a tool that prioritizes logic over emotion. I still have many ideas for Marylin, and I am particularly excited to see her mature and become more independent.

There are several directions to explore: (1) increased automation, (2) lower versus higher-frequency updates, (3) expanding versus narrowing the asset universe, and (4) improving hold versus sell decision-making. In short, 2026 will not be boring.

Here’s to year two. 🥂

💸 Are you ready to hand over your money to AI yet? 💸

About PrettyModels AI

PrettyModels.ai mines the vast financial knowledge embedded in leading Large Language Models to generate superior investment strategies. Our mission is to transform the world’s chaotic qualitative information into robust, quantitative trading edges for the public stock market. Marylin is our first model release.

Link to Marylin Wikifolio (to track live portfolio and performance)

Link to PrettyModels.ai (to analyze underlying scores and methodology)

Disclaimer & Conflict of Interest Declaration

1. No Investment Advice (Keine Anlageberatung) The content presented in this blog post, specifically regarding the “Marylin” strategy and the associated Wikifolio, is for informational and educational purposes only. It does not constitute financial, investment, tax, or legal advice. The information provided is not a recommendation to buy, sell, or hold any specific securities (such as NVIDIA or Alphabet) or financial instruments (such as the Wikifolio certificate).

2. No Offer or Solicitation (Kein Angebot) This post is not an offer to sell or a solicitation of an offer to buy any securities. Decisions to invest in financial instruments should be made solely on the basis of the official prospectus and the Key Information Document (KID) available on the respective issuer’s or platform’s website.

3. Risk Warning (Risikohinweis) Investments in financial markets, particularly in equities and Wikifolio certificates, are subject to market risks. Historical performance—such as the performance data of “Marylin” from 2024–2025 mentioned in this post—is not a reliable indicator of future results. Capital is at risk, and a total loss of the invested amount is possible.

4. Conflict of Interest (Interessenskonflikt) In accordance with German regulations (WpHG and MAR), the author (Christian Tausch) hereby discloses a potential conflict of interest:

- The author is the creator and trader of the “Marylin” Wikifolio strategy described in this text.

- The author invests his own capital in this Wikifolio and/or the underlying securities mentioned (e.g., Alphabet, NVIDIA).

- Consequently, the author benefits financially from the positive performance of these assets and the Wikifolio certificate.

5. Limitation of Liability (Haftungsausschluss) While the AI-driven data and scoring models (Marylin) are designed to process financial information accurately, the author assumes no liability for the correctness, completeness, or timeliness of the data provided. The author is not liable for any direct or indirect losses arising from the use of the information contained in this blog post.

“Skill is successfully walking a tightrope over Niagara Falls.

Marilyn Vos Savant

Intelligence is not trying.”