There are many questions that rob me of my sleep at night… but one of the strangest is certainly:

Why should I (now) forecast PE fund cash flows?

In this article, I will explain fund investors (LPs) and fund managers (GPs) why they should dedicate some of their daytime to this important and fascinating topic. The new findings surely have the potential to significantly improve their nighttime rest. I promise.

Why are forecasts important for PE fund investors?

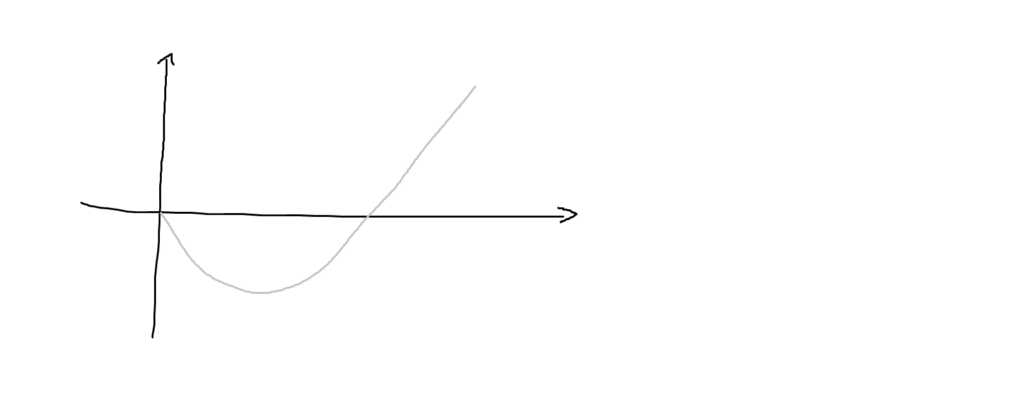

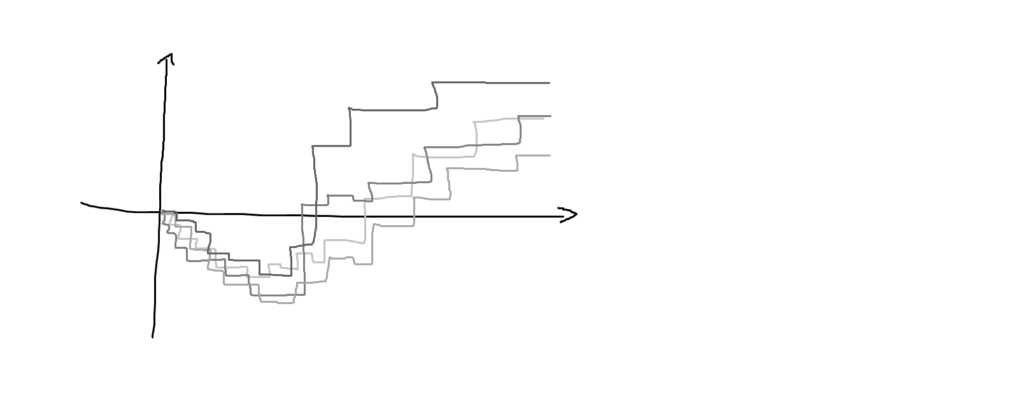

- To better understand the timing and magnitude of expected cash inflows and outflows. This can help Private Equity (PE) investors assess their portfolios’ liquidity and profile of future cash flows.

- To plan for future capital needs. By forecasting cash flows, investors can get a sense of the fund’s future capital requirements and whether they will need to provide additional capital to meet these needs.

- To evaluate the fund manager’s ability to generate returns and manage the fund’s financial resources effectively. By comparing actual cash flows to forecasted cash flows, investors can assess the fund manager’s performance and make more informed decisions about whether to continue investing in the fund manager.

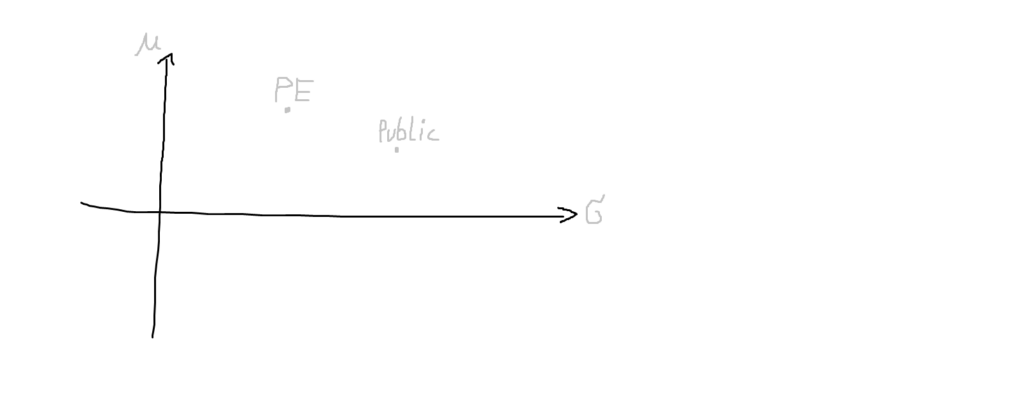

- To assess the fund’s risk profile. By forecasting cash flows, investors can better understand the potential risks and uncertainties associated with the fund’s investments, and make more educated decisions about their level of risk tolerance.

- To plan for future investments. Forecasting cash flows can help investors understand the expected capital calls (and distributions) of the current PE program. Moreover, it gives advice on when it makes sense to commit to new PE funds in order to maintain a certain level of private equity exposure.

In summary, cash flow forecasts are essential to improve the short-term liquidity planning and future commitment planning for Limited Partners’ portfolios. However, also related topics like risk management and performance benchmarking could strongly benefit from accurate cash flow projections. For fund investors (a.k.a. Limited Partners) forecasts on fund level are usually most beneficial.

Why are forecasts important for PE fund managers?

- To fulfill regulatory risk reporting and stress testing requirements. Liquidity stress tests are mandatory exercises for Alternative Investment Fund Managers (AIFMs) in many jurisdictions.

- To identify risk factors that impact the fund’s future performance. Analyzing the sensitivity to certain macro factors improves the understanding of how macroeconomic downturns might affect the future fund development.

- To calculate expected fee and carry payments. Good cash flow forecasts can tremendously improve the precision of projections of the future General Partner income.

- To plan for future fundraising efforts, as a forecast can help the fund manager determine how much capital will be needed to meet future investment opportunities and commitments. It can also be a great marketing tool to convince new potential fund investors.

- To provide transparency and information to investors. By forecasting cash flows, fund managers can provide investors with a clear understanding of the fund’s expected financial performance, which can help to build trust and confidence in the fund (especially while fundraising or in the early stages of a fund’s lifetime).

To conclude, fund managers use detailed cash flow forecasts mainly for (i) regulatory risk reporting, the calculation of the expected fee and carry income, and (iii) fundraising or marketing purposes. For fund managers (a.k.a. General Partners), cash flow modeling is commonly more critical on deal level.

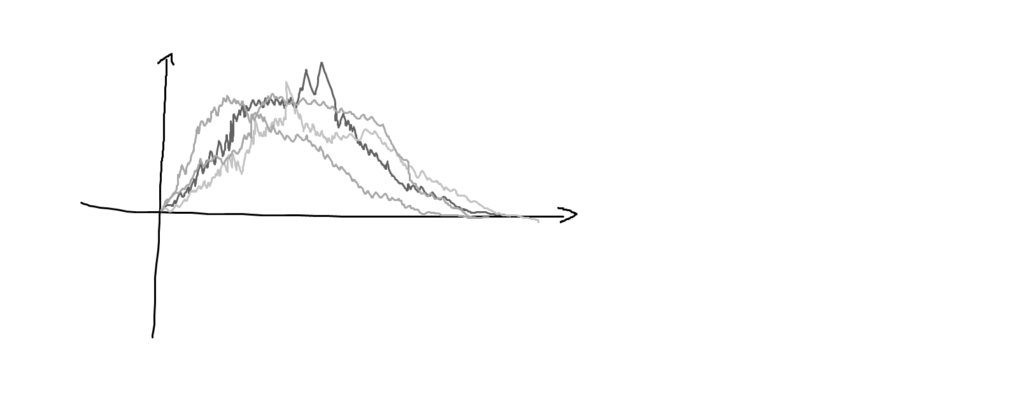

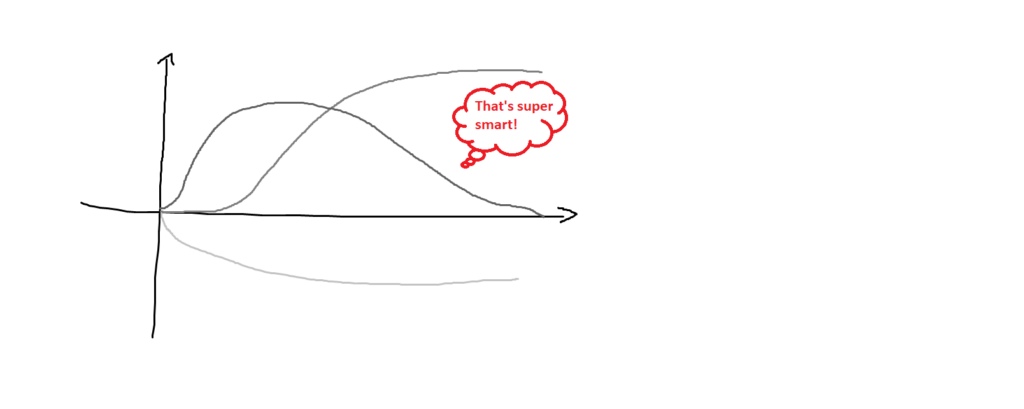

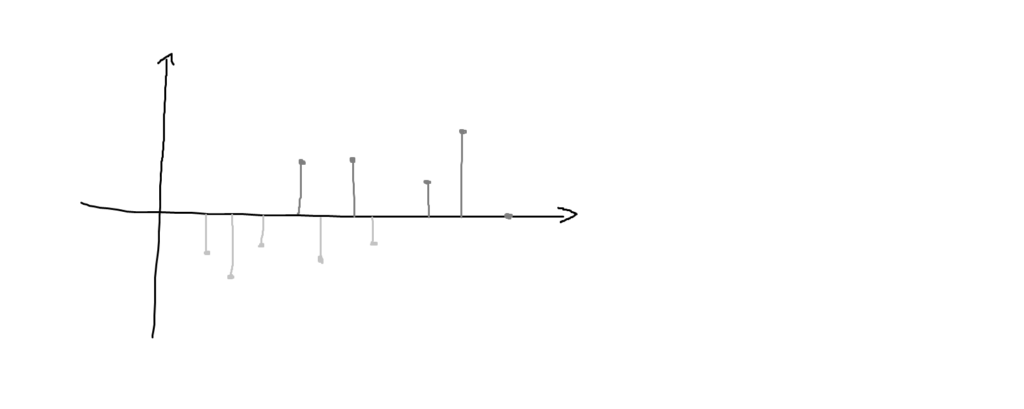

Popular models for PE fund cash flows

Where can I read more?

You are now convinced of the importance of proper cash flow forecasts for PE funds and want to read more?

Fortunately, I just finished a series of three blog posts on cash flow forecasting, which are all published on the AssetMetrix webpage.

You can learn about three exiting topics:

- Liquidity Stress Testing: How bulletproof is your private equity fund?

- Liquidity Planning: How to make liquidity planning smarter, better, faster, stronger?

- Methodology: Private equity fund cash flow forecasting – the sophisticated approach

Enjoy reading now!