How to compare private and public equity investments?

Several competing Public Market Equivalent (PME) methodologies had been developed to make private equity fund performance comparable to public equity and determine the ex-post best investment alternative. The idea is to compare and unify common PME approaches from a (1) Stochastic Discount Factor (SDF) and (2) cash flow replication perspective. We mainly focus on how a dynamic SDF framework can be used to price (or better evaluate) the observed cash flows of private equity funds, since replication of cash flows had been tackled in the last blog post.

How to convert a panel of fund cash flows into a total return index?

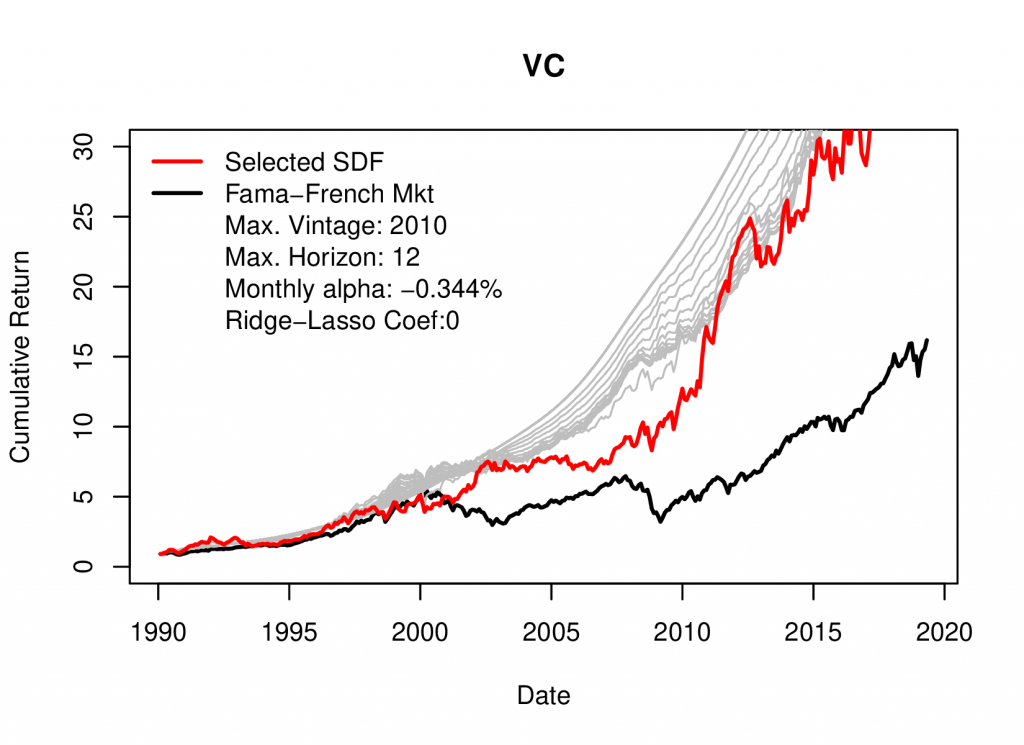

After we identified and estimated a suitable SDF model for private equity investments, we can construct a total return index that tracks the performance of private equity in a straightforward manner. As multiple estimation challanges arise due to the notorious reliable data scarcity in private equity, we apply an elastic net regularization framework to obtain (more) reasonable SDF results.

Presentation slides can be found here.

R code can be found on GitHub.

Example: SDF for Venture Capital (VC) funds

The optimal elastic net (ridge-lasso) penality term is estimated here using cross validation with an approximately 50/50 training-validation data partition split, since asymptotic theorey for model consistency requires large validation set sizes.